US-China Watch

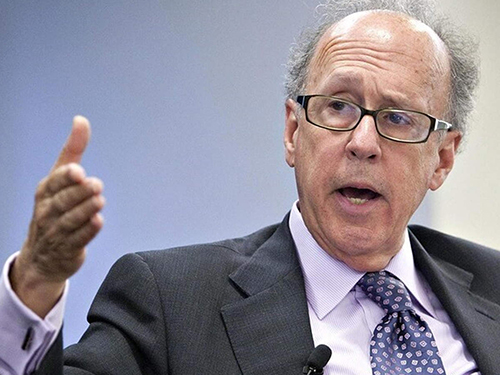

With the world in flux as never before, macroeconomic insight and analysis is always at risk of chasing a moving target. That is especially the case when it comes to the US-China conflict, driven by the oft unpredictable crosscurrents between the world’s two largest economies and their ambitious geostrategic aspirations. Through the combination of blogging and tracking the rapidly shifting news flow, the weekly updates below will attempt to keep you abreast of the latest developments on the US-China watch.

The Excess Capacity Debate

Chinese leaders are stressing two major themes driving their current growth strategy—an industrial upgrading that draws on “new productive forces” and a long overdue boost to household demand. Of these two areas of focus, the emphasis on production is getting the greatest attention—both inside of China and in the world at large. That’s not to say Beijing doesn’t recognize the importance of consumer-led structural rebalancing. Perhaps it’s just a tougher goal to achieve, especially given the immediacy of China’s growth challenges.

Industrial upgrading is well aligned with modern China’s central planning legacy that was grounded in state management of the production side of the Chinese growth equation. In a recent article in Qiushi, the CPC’s leading ideological journal, President Xi drew on this legacy, focusing special attention to new productive forces that he defined as those “…fostered by revolutionary technological breakthroughs, innovative allocation of production factors, and deep transformation and upgrading of industries.” Chinese state media was quick to celebrate this statement as “…an innovation and development of Marxist theory of productive forces.”

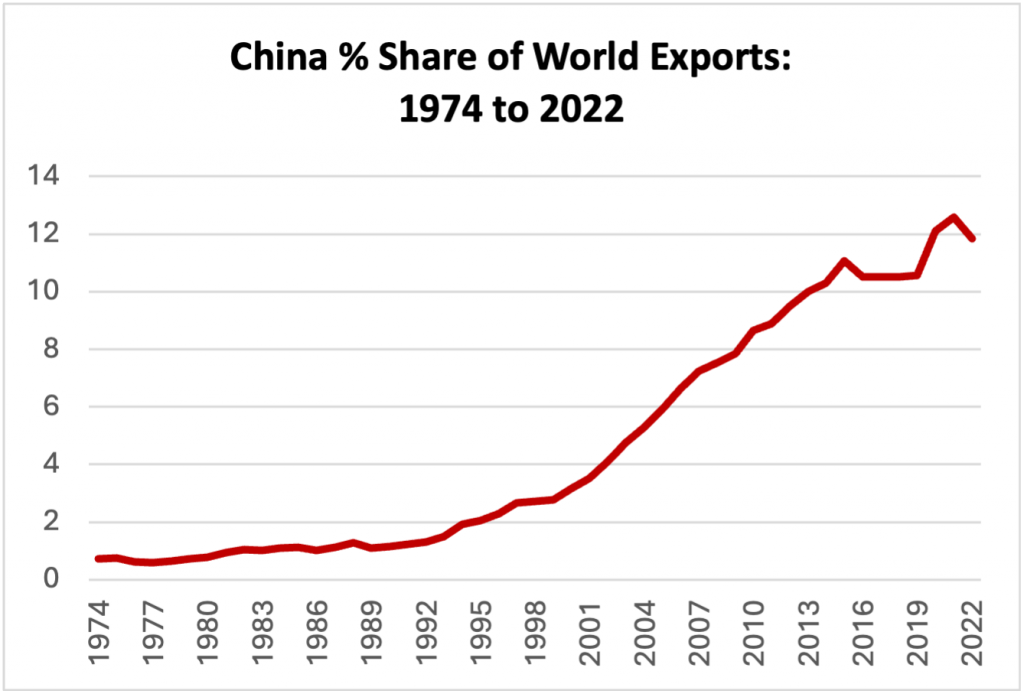

Led by the United States, the West has interpreted this emphasis as a threat, especially focused on three sectors of advanced industrial activity—solar panels, electric vehicles (EVs), and lithium batteries. Mindful of the likely mismatch between the prompt response of China’s production-focused efforts and the lagging response of a consumer-led impetus, both the US and the EU fear this will result in an overhang of excess Chinese capacity that will flood global markets and crush their own efforts in these same key sectors. In a recent Reuters interview, US Treasury Secretary, Janet Yellen, underscored this point following her recent trip to China, saying that “…it’s important that China recognize the concern and begin to address it.”

The recent weakness in the renminbi underscores the potential of another dimension to this threat—that a deliberate currency depreciation might unfairly boost the price competitiveness of Chinese exports. The RMB has, in fact, declined by nearly 12% versus the US dollar over the past two years and could well fall further if the Chinse economy continues to under-perform in an early-stage deflationary climate. Needless to say, if Beijing were to abandon its current regime of trading-band management and consciously push the RMB down further that would evoke howls of protest from US authorities and undoubtedly trigger significant spillovers that could lead to competitive currency devaluations by others in Asia.

This possibility bears watching. While the cross-rate between the RMB and the US dollar gets the headlines, what matters most for overall price competitiveness are trade-weighted movements of its currency against those of a large cross-section of its trading partners. On this basis, through March 2024, the real effective RMB relative to a basket of some 64 countries was down some 13.8% from its March 2022 peak, according to BIS metrics. While hardly an insignificant decline, the real effective RMB is still up some 40% from its December 2004 low point. In other words, despite its recent weakening, the long-term trend of RMB appreciation remains intact. This is at odds with the growing view in some quarters that China may be shifting its currency policy to support allegations of dumping its exports of excess production into global markets.

Currency considerations aside, Washington’s reaction to China’s production-oriented growth strategy is unnecessarily confrontational. The supply-demand mismatch noted above could have been framed by Janet Yellen as more of a problem with China’s deficient state of domestic demand, especially household consumption. Rather than threaten China with another round of protectionist actions as a penalty for export-led growth, a more constructive approach would have been to underscore the imperatives of consumer-led rebalancing as the means to absorb excess domestic production. That outcome, closing the supply-demand gap by boosting internal consumer demand, is a far less confrontational proposition for a deeply conflicted US-China relationship. Unfortunately, in a climate of increasingly strident Sinophobia, that softer approach has fallen on deaf ears in Washington.

Perhaps the most contentious aspect of this problem is America’s ultimate ability to compete with China in the modern industries that are the focus of the industrial upgrading—areas like solar panels, EVs, and batteries. The US complains that China supports these new growth sectors by vast subsidies to its state-owned enterprises. Yet that assertion appears to be at odds with the shifting mix of China’s manufacturing surplus—away from subsidized SOEs toward unsubsidized private companies. Moreover, this allegation is laced with hypocrisy. It overlooks the historical role that US government subsidies have long played in promoting new technologies; most recently, that includes Tesla, America’s first-mover champion in electric vehicles, as well as alternative, green energy initiatives underwritten by the Inflation Reduction Act of 2022.

In the end, there are big questions that can be raised about China’s growth strategy. Many, including me, have long argued that Chinese economic growth has been more about supply than demand. But now, with two of China’s major growth drivers under serious pressure—a crisis-impacted property sector and tariff-constrained external demand from the United States—the imperatives of Chinese growth targeting have forced more incremental growth into the new industries where China’s vast scale, modern technologies, and cost competitiveness provide enormous comparative advantage. Professor Yang Yao of Peking University, one of China’s most outstanding economists, makes the compelling point that largely for those reasons, the United States will never be able to outcompete its Chinese rivals in many of the new modern industries. Washington obviously feels differently and is increasingly determined to fight for a different outcome.

And so, the debate over excess Chinese capacity has now become a new dimension of the US-China conflict. That is likely to continue until, or unless, China closes the excess supply gap from the demand side. Barring that outcome, China’s unbalanced growth structure is likely to remain a big question for its longer-term development aspirations. Moreover, in an unbalanced, increasingly fractionalized world economy, the excess capacity debate is likely to be a big problem for the rest of us. Both stands of this debate point to increased conflict escalation between the United States and China.

You can follow me on X/Twitter @SRoach_econ

The Voodoo of China Hawks

There is a growing and increasingly vocal constituency in the United States that favors a kinetic war with China. Look no further than hallowed pages of Foreign Affairs, America’s preeminent platform of intellectual engagement on international policy. In the upcoming...

China’s Growth Shock

Whether it is a race car or an economy, deceleration is all relative. If a sleek, high-performance race car slows abruptly from a speed of 200 miles an hour to 50 miles per hour, a passenger without a seatbelt might be thrown through the windshield, Similarly, for an...

What’s the Point?

That is the tough question that I am now asking myself after my recent trip to Beijing to attend the 25th annual China Development Forum (CDF). Having been to all but the first CDF in 2000, my participation over each of the ensuing 24 years makes me the...

Views from a friend

It is always a pleasure for me to be at the China Development Forum. I have attended this event for 24 years in a row, only missing the first CDF in 2000. I have been to every single one since—making me the longest attending foreign participant. Over the years, the...

The Spirit of the China Development Forum

It’s that time of the year—late March, when for each of the past 24 years I have gone to Beijing to attend the China Development Forum (during Covid, two of those meetings were virtual). While I missed the first meeting in 2000, I have been there every year since....

Sinophobia Unhinged

It has been building for years. It started in the early 2000s when the United States and its allies first raised security concerns over allegations of the so-called backdoor espionage potential embedded in Huawei’s telecommunications networking products. China’s...

Chinese Tea Leaves

At this time of the year, the eyes of China watchers turn to the annual “two sessions” meetings taking place in Beijing. Two parallel gatherings in Beijing—the nation’s elected legislature (National People’s Congress) and the political advisory organization of the...

EV Paranoia

America’s Sinophobia seems to have no limits. That’s especially the case with the US-China tech war. First, it was Huawei’s alleged backdoor threat to 5G telecommunications platforms. Then it was TikTok, followed more recently by the escapades of China’s Volt Typhoon...

Making Trouble in Hong Kong

My recent opinion piece in the Financial Times, “It pains me say Hong Kong is over,” has stirred up quite a debate in the city-state that I used to call home. Unsurprisingly, Hong Kong politicians have been especially critical. But former colleagues, business...

Call in the FBI!

I’ve got to give Congressman Mike Gallagher (R-Wisconsin) credit for one thing: As Chairman of the new House Select Committee on China (actually the CCP, to be technically correct), he has made more effective use of the bully pulpit than anyone in Washington has for a...